ny highway use tax rates

How to Determine Your Highway Use Tax Tax Bulletin HU-360 TB-HU-360. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

Receiver Of Taxes Town Of Oyster Bay

See Tax Bulletin An In See more.

. IFTA Final Use Tax Rate and Rate Code Table 2 - 2nd Quarter 2022. For forms and publications call. The state of New York applies its own HUT highway use tax for many different motor carriers.

HUTIFTA Application Deposit Unit. Highway Use Tax Web File You can only access this application through your Online Services account. The highway use tax is computed by multiplying the number of miles.

IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022. Federal law requires proof that the HVUT tax was paid when you register a. The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway.

22 rows IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022. Highway Use Tax Return MT-903-I 122 General instructions For information including whats new about the highway use tax HUT visit our website search. For more information about the changes see TB.

IFTA Final Use Tax Rate and Rate Code Table 2 - 3rd Quarter 2021. To calculate the tax you first need to find the total number of miles traveled on. The New York Highway Use Tax is calculated from a few factors but mileage is the most important part.

IFTA Final Use Tax Rate and Rate Code Table 2 - 2nd Quarter 2021. These are carriers that operate vehicles across New York State public. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the.

If you are receiving this message you have either attempted to use a bookmark. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS.

What is the New York Highway Use Tax. NYS Taxation and Finance Department. Highway Use Tax Web File You can only access this application through your Online Services account.

The highway use tax is computed by multiplying the number of. If you are receiving this message you have either attempted to use a bookmark. Who must file You must.

The New York use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New York from a state with a lower sales tax rate. New York State imposes a highway use tax HUT for motor carriers operating certain motor vehicles on NYS public highways excluding toll-paid. IFTA-1051 921 Instructions on form.

Highway Use Tax TB-HU-360 August 1 2014 How to Determine Your Highway Use Tax. IFTA-1051 722 Instructions on form. If you use the Highway Use Tax Web File application it will automatically display your correct filing frequency annual quarterly or monthly.

Sales Tax Rates Additional Sales Taxes And Fees

Florida Car Sales Tax Everything You Need To Know

New York Hut Mileage And Highway Use Tax

Nyc Dot Trucks And Commercial Vehicles

How Are Your State S Roads Funded Tax Foundation

Ny Hut Highway Use Tax Laws Vehicle Status Payment Requirements The Benjamin Goldman Law Office

How To File A Sales And Use Tax Return With One Selling Location Using A Limited Access Code Youtube

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

New York City Sales Tax Rate And Calculator 2021 Wise

Nyc Dot Trucks And Commercial Vehicles

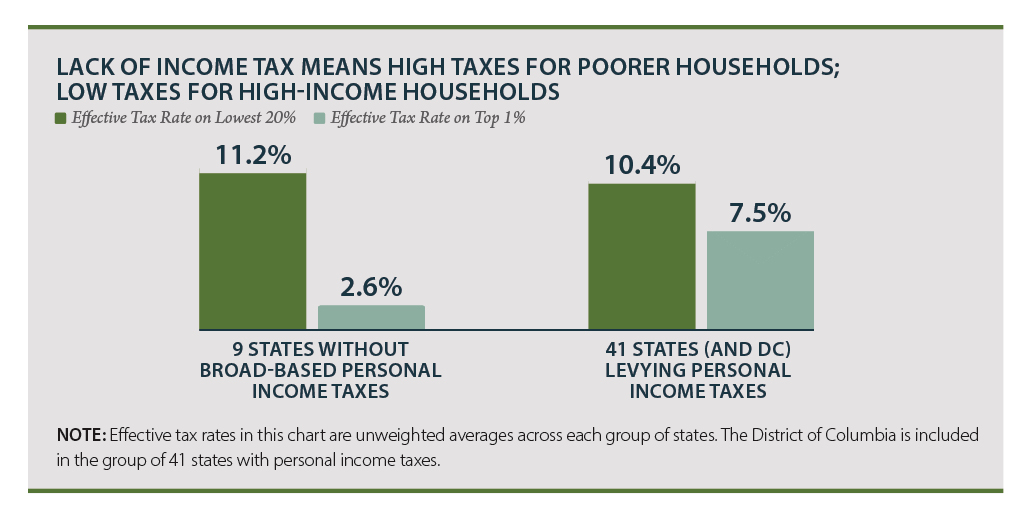

How Do State And Local Individual Income Taxes Work Tax Policy Center

General Sales Taxes And Gross Receipts Taxes Urban Institute

Diesel Fuel Tax To Rise Sharply In Ct Experts Say Costs Will Hit Consumers

Heavy Highway Use Tax Calculator For Heavy Vehicles

Car Insurance For High Risk Drivers In New York Bankrate

Nyc Dot Trucks And Commercial Vehicles

Dentons Global Tax Guide To Doing Business In The United States

Irs Announces 2018 Mileage Rates Even Though Tax Reform Talks May Limit Use